Hey there, fellow money-movers! Are you ready to kick off 2024 with a financial bang? It’s time to ditch the daydreams and take some real action to get your finances in order. This year, we’re flipping the script on money stress and paving the way for a brighter financial future.

So buckle up and get ready for some practical tips tailored just for you. With a little motivation and empowerment, you can make 2024 your year of financial breakthrough. Let’s dive in!

Increasing Your Income

First up, let’s talk about boosting that bank balance. If you’ve been crushing it at work, it might be time to ask for that well-deserved raise. Do your research, make your case, and don’t be afraid to shoot your shot. The worst they can say is no, right?

Looking to hustle on the side? A side gig could be your ticket to some extra cash. Whether it’s selling your crafts on Etsy or flexing your writing skills with some freelance gigs, there are endless opportunities to turn your hobbies into moneymakers.

You can also get your creative juices flowing with content creation on OnlyFans! This platform opens up exciting opportunities for extra income while letting you unleash your creativity. Dive into success stories and get inspired by creators such as the top nude Only Fans models!

And hey, if your company hands out bonuses, why not put your name in the hat? If you’ve been putting in the work, it’s worth asking for that little something extra.

Saving and Investing Wisely

Saving money is not as complex as it seems. You can start by taking small steps and witnessing how those savings accumulate gradually. Even if you manage to save just a few dollars each month, each contribution matters. When it comes to reducing expenses, think big. Whether you are cutting down your grocery expenses or considering refinancing your mortgage, these savings can accumulate rapidly.

Are you prepared to elevate your financial game? It’s time to venture into the realm of investing. While the stock market can be a rollercoaster, in the long term, these investments can yield significant returns. Therefore, do not hesitate to embark on this journey and let your money work for you. Remember, every penny saved is a step closer to financial stability and a secure future. By being mindful of your spending habits and exploring investment opportunities wisely, you can pave the way for a prosperous financial future.

Managing Debt

Got some debt piling up and dragging you down? It’s time to face that financial challenge head-on. Start by evaluating your expenses and cutting down on unnecessary costs. Every little bit you save can be redirected towards paying off those high-interest debts, helping you take control of your financial situation.

Remember, you don’t have to navigate this journey solo. Seeking guidance from a financial counselor can provide you with valuable insights and strategies to tackle your debts effectively. They can assist in crafting a personalized plan to address your specific financial needs and even negotiate for lower interest rates on your behalf. By taking proactive steps and seeking professional advice, you can work towards a brighter, debt-free future.

Don’t let financial burdens hold you back – empower yourself with knowledge and the right tools to overcome these challenges.

Setting Clear Financial Goals

To make 2024 your year of financial domination, you’ve gotta have a game plan. Whether it’s paying off debt, saving for a rainy day, or finally taking that dream vacation, set your sights on some specific goals and go after them with everything you’ve got. Break those big goals down into bite-sized chunks and celebrate every milestone along the way.

Achieving financial success requires determination and perseverance. Start by assessing your current financial situation. Create a budget that aligns with your goals and track your expenses diligently. Consider automating your savings to make it easier to build your financial reserves.

Investing in yourself through education or acquiring new skills can open up opportunities for growth and increased income. Explore different investment options to make your money work for you. Diversification is key to managing risk in your investment portfolio.

Remember, financial success is a journey, not a sprint. Stay committed to your goals, adapt to changes, and seek advice from financial professionals when needed. With patience and smart decision-making, you can make 2024 a year of significant financial progress.

Creating a Budget

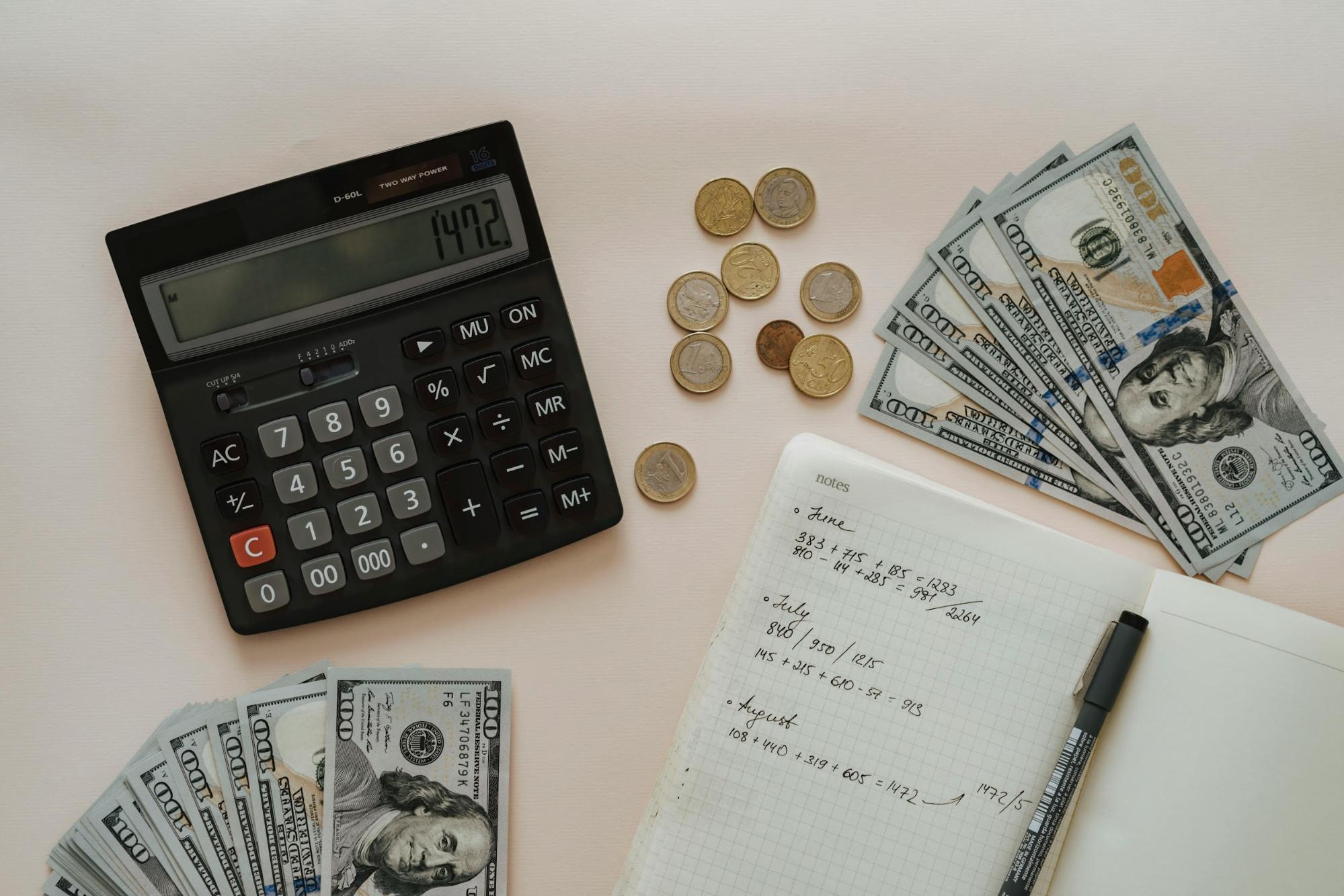

Last but not least, let’s delve into the realm of budgeting, a crucial element in maintaining financial stability and preventing unnecessary overspending. Take a moment to sit down, meticulously analyze the figures, and gain a clear understanding of your spending habits. Remember, occasional slip-ups are part of the journey – embrace them as opportunities for growth. Ultimately, budgeting is a continuous process focused on improvement rather than flawless execution.

Make use of tools like budgeting apps or spreadsheets to track your expenses and monitor your progress. Consider involving your family members in the budgeting process, as their support can be invaluable in achieving financial goals.

By taking control of your finances through budgeting, you can make informed decisions and prioritize savings for future needs.

Empowering Your Financial Future

So there you have it – a well-crafted roadmap to achieving financial success in 2024. It’s time to transform those aspirations into tangible actions. With a dash of motivation and a generous sprinkle of unwavering determination, you have the power to make this year your most remarkable one to date.

Therefore, don’t hesitate any longer. Take that pivotal first step towards your goals, and prepare yourself to conquer every financial milestone you set. Remember, the future is brimming with opportunities waiting to be seized by you!